To save the most money, the best way to find affordable quotes for Acura ZDX insurance in Jacksonville is to annually compare prices from insurers in Florida.

To save the most money, the best way to find affordable quotes for Acura ZDX insurance in Jacksonville is to annually compare prices from insurers in Florida.

- Step 1: Try to understand the different coverages in a policy and the factors you can control to prevent rate increases. Many rating factors that are responsible for high rates such as traffic tickets, fender benders, and a negative credit history can be rectified by making minor changes in your lifestyle.

- Step 2: Compare price quotes from independent agents, exclusive agents, and direct companies. Direct companies and exclusive agencies can provide rates from a single company like Progressive or Farmers Insurance, while agents who are independent can provide rate quotes from multiple insurance companies.

- Step 3: Compare the new quotes to your existing policy to see if you can save by switching companies. If you can save some money and change companies, make sure there is no lapse in coverage.

The key thing to remember is that you’ll want to make sure you compare the same liability limits and deductibles on each quote request and and to get price quotes from all possible companies. Doing this provides a fair rate comparison and a good representation of prices.

Unfortunately, the majority of drivers have stayed with the same insurance company for at least the last four years, and about 40% of consumers have never even compared rates from other companies. With the average premium in the United States being $1,847, drivers could save an average of about $859 each year, but they just don’t understand how easy it is to compare rate quotes.

If you have insurance now or need new coverage, use these techniques to save money while maintaining coverages. Comparison shopping for the best-priced insurance in Jacksonville is not that difficult. Drivers only have to learn the most effective way to compare rate quotes online.

Lowering your insurance rates is pretty simple and can save money. All that’s required is to spend a few minutes on the computer to get quotes to discover which company has inexpensive Jacksonville car insurance quotes.

The auto insurance companies shown below offer quotes in Florida. If the list has multiple companies, it’s highly recommended you visit as many as you can in order to get a fair rate comparison.

Rates and data analysis

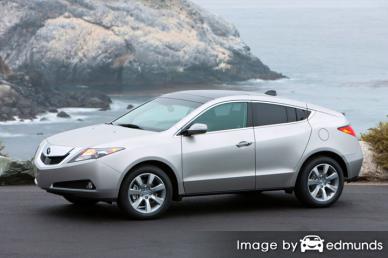

The rate information shown next covers a range of coverage prices for Acura ZDX models. Being more informed about how insurance policy premiums are formulated helps drivers make smart choices when comparing insurance rates.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $510 | $736 | $546 | $32 | $164 | $1,988 | $166 |

| ZDX AWD | $510 | $736 | $546 | $32 | $164 | $1,988 | $166 |

| ZDX Advance Package AWD | $510 | $834 | $546 | $32 | $164 | $2,086 | $174 |

| Get Your Own Custom Quote Go | |||||||

Above prices assume single male driver age 30, no speeding tickets, no at-fault accidents, $250 deductibles, and Florida minimum liability limits. Discounts applied include homeowner, multi-policy, claim-free, multi-vehicle, and safe-driver. Table data does not factor in vehicle location which can revise rates noticeably.

The illustration below illustrates how choosing a deductible and can increase or decrease Acura ZDX insurance premiums for different age categories. The premiums are based on a married male driver, comp and collision included, and no discounts are factored in.

Insurance cost for men versus women in Jacksonville

The information below shows the difference between Acura ZDX insurance prices for male and female drivers. The premium estimates are based on no claims or violations, comp and collision included, $1,000 deductibles, single marital status, and no additional discounts are factored in.

Three reasons auto insurance is important

Even though it can be expensive, buying auto insurance is required in Florida but it also protects you in many ways.

- Almost all states have mandatory liability insurance requirements which means you are required to buy a specific level of liability insurance coverage in order to drive the car legally. In Florida these limits are 10/20/10 which means you must have $10,000 of bodily injury coverage per person, $20,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you took out a loan on your Acura, most banks will have a requirement that you have comprehensive coverage to guarantee their interest in the vehicle. If coverage lapses or is canceled, the lender may have to buy a policy to insure your Acura at a significantly higher premium and force you to pay for the expensive policy.

- Auto insurance protects both your assets and your Acura ZDX. It will also pay for medical bills for you, your passengers, and anyone else injured in an accident. Liability coverage also covers legal expenses if you are sued as the result of an accident. If mother nature or an accident damages your car, comprehensive and collision coverage will pay to restore your vehicle to like-new condition.

The benefits of insuring your ZDX greatly outweigh the cost, especially for larger claims. According to a 2015 survey, the average American driver overpays more than $869 every year so smart consumers compare quotes at least once a year to make sure the price is not too high.

Lower Your Jacksonville Insurance Costs

Lots of factors are used when quoting car insurance. Some are obvious such as your driving record, but others are more obscure like your vehicle usage or your financial responsibility. Part of the car insurance buying process is learning the factors that help calculate your premiums. If you have a feel for what controls the rates you pay, this enables you to make decisions that may result in cheaper rates.

Vehicle theft costs us all – Owning a car with a theft deterrent system can earn a premium discount. Theft prevention devices such as vehicle immobilizer systems, OnStar, and tracking devices like LoJack all aid in stopping your vehicle from being stolen.

Safer vehicles lower prices – Vehicles with good safety scores tend to be cheaper to insure. The safest vehicles reduce occupant injuries and reduced instances of injuries means your insurance company pays less and lower rates for you.

Low stress vocation equals lower prices – Did you know your occupation can influence how much you pay for car insurance? Careers like real estate brokers, airline pilots, and emergency personnel generally have higher rates than average due to intense work requirements and long work days. On the other hand, occupations like professors, engineers and the unemployed have lower than average premiums.

Getting married brings a discount – Walking down the aisle may cut your premiums on your car insurance bill. Having a significant other generally demonstrates drivers are more mature than a single person and it’s statistically proven that married drivers tend to have fewer serious accidents.

Drive lots and pay more – The more you drive in a year the higher your rate. A lot of companies charge to insure your cars based upon how much you drive. Vehicles that have low annual miles qualify for better rates than vehicles that have high annual mileage. Having the wrong rating on your ZDX may be costing you. It’s a good idea to make sure your car insurance policy is showing the correct usage for each vehicle.

High deductibles lower premiums – Physical damage protection, aka comp and collision, is used to repair damage to your vehicle. Some instances where coverage would apply are running into the backend of another car, vandalism, or theft. The deductibles represent how much money you are willing to pay out-of-pocket if a claim is determined to be covered. The more you are required to pay out-of-pocket, the less your car insurance will be.

Your location is important – Being located in less populated areas is a positive aspect if you are looking for the lowest rates. Lower population means less chance of accidents and also fewer theft and vandalism claims. People in densely populated areas regularly have more road rage incidents and much longer commute distances. Higher commute times can result in more accidents.

Which policy gives me the best coverage?

When it comes to choosing coverage online or from an agent, there really isn’t a single plan that fits everyone. You are unique and your car insurance should unique, too.

For example, these questions may help highlight whether your personal situation may require specific advice.

- Can good grades get a discount?

- Will I be non-renewed for getting a DUI or other conviction?

- Am I getting all the discounts available?

- Am I covered by my employer’s commercial auto policy when driving my personal car for business?

- What does medical payments coverage do?

- When does my teenage driver need to be added to my policy?

- Is my dog or cat covered if injured in an accident?

- If my car is totaled with they pay enough to replace it?

- Why are teen drivers so expensive to add on to my policy?

If it’s difficult to answer those questions but a few of them apply then you might want to talk to a licensed insurance agent. If you want to speak to an agent in your area, take a second and complete this form or you can go here for a list of companies in your area. It only takes a few minutes and you can get the answers you need.

Cheap coverage is out there

More affordable car insurance in Jacksonville is attainable on the web as well as from insurance agents, so you should compare both in order to have the best price selection to choose from. Some car insurance companies do not provide price quotes online and usually these small, regional companies provide coverage only through independent agencies.

In this article, we covered a lot of tips how to shop for Acura ZDX insurance online. It’s most important to understand that the more rate comparisons you have, the better your comparison will be. You may even discover the biggest savings come from the smaller companies. Regional companies often have lower premium rates on specific markets as compared to the big name companies such as Progressive and GEICO.

Even more information is located by following these links:

- Front crash protection reduces rear-end crashes (Insurance Institute for Highway Safety)

- Who Has the Cheapest Car Insurance Rates for Good Students in Jacksonville? (FAQ)

- Safe Vehicles for Teens (iihs.org)

- Tools for Teen Driving Safety (State Farm)

- What to do at the Scene of an Accident (Insurance Information Institute)