Wish you could get out of an expensive car insurance policy? Say no more because many Jacksonville consumers are in the same pinch.

Wish you could get out of an expensive car insurance policy? Say no more because many Jacksonville consumers are in the same pinch.

Unbelievable but true according to a study a large majority of drivers kept buying from the same company for a minimum of four years, and almost 40% of drivers have never compared rates to find lower-cost insurance. With the average car insurance premium being $1,847, U.S. drivers could save themselves approximately $859 a year just by getting comparison quotes, but most just don’t grasp the actual amount they would save if they switched to a more affordable policy.

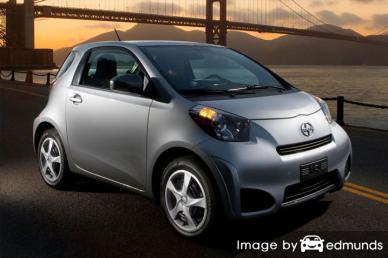

Steps to finding cheaper rates for Scion iQ insurance in Jacksonville

If your goal is the lowest price, then the best way to find discount Scion iQ insurance is to compare prices once a year from companies who provide car insurance in Jacksonville. Drivers can shop around by following these steps.

Step 1: Try to learn a little about how your policy works and the changes you can make to prevent expensive coverage. Many policy risk factors that cause high rates such as speeding and an unacceptable credit rating can be eliminated by making lifestyle changes or driving safer. Keep reading for information to get low prices and find available discounts that you may qualify for.

Step 2: Compare price quotes from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can provide rates from a single company like Progressive or Allstate, while agents who are independent can give you price quotes for many different companies. Find a Jacksonville insurance agent

Step 3: Compare the new rate quotes to your existing rates to see if switching to a new carrier will save money. If you find a better price and change companies, make sure coverage is continuous and does not lapse.

Step 4: Tell your current company to cancel your current auto insurance policy. Submit payment and a completed application to your new company or agent. Once the paperwork is finalized, put the new proof of insurance certificate in an accessible location in your vehicle.

The most important part of this process is to make sure you enter identical limits and deductibles on each quote request and and to get quotes from every company you can. Doing this provides a fair rate comparison and the best price quote selection.

There are many auto insurance companies to pick from, and though it is a good thing to have multiple companies, lots of choices makes it harder to compare rates and cut insurance costs.

Buying affordable auto insurance in Jacksonville is actually quite easy if you know where to start. If you have auto insurance now, you will surely be able to save money using the concepts covered in this article. Shoppers just need to know the most time-saving way to compare rates online from multiple companies.

How to Lower Your Insurance Costs

Lots of things are taken into consideration when quoting car insurance. Some are pretty understandable such as your driving history, although others are more transparent like your continuous coverage or your financial responsibility. Part of the auto insurance buying process is learning the different types of things that help determine your policy premiums. When consumers understand what impacts premium levels, this allows you to make educated decisions that could help you find lower premium levels.

The items below are some of the most common factors used by your company to calculate your rate level.

- Liability coverage is important – Liability coverage is the protection if ever you are found liable for damages from an accident. Liability provides legal defense up to the limits shown on your policy. It is affordable coverage compared to insuring for physical damage coverage, so do not skimp.

- Safety first – Safer cars are cheaper to insure. These vehicles help reduce the chance of injuries in an accident and fewer injuries translates into savings for insurance companies and thus lower rates.

- Cheaper rates after marriage – Having a significant other actually saves money on auto insurance. Having a spouse demonstrates that you tend to be more mature than a single person it has been statistically shown that drivers who are married are more cautious.

- Do you work long hours in a demanding job? – Did you know that where you work can have an impact on rates? Occupations such as real estate brokers, architects, and emergency personnel tend to have higher rates than the rest of us attributed to high stress levels and extremely grueling work hours. On the other hand, jobs such as professors, historians and homemakers pay the least.

- How old are your drivers? – Older insureds are more cautious drivers, tend to cause fewer accidents, and are safer drivers. Inexperience drivers are statistically shown to be inattentive when driving therefore auto insurance rates are much higher.

- Premiums are impacted by vehicle performance – The type of car you drive makes a substantial difference in the rate you pay. The lowest performance passenger cars generally receive the lowest base rates, but the cost you end up paying is determined by many additional factors.

- Insurance companies don’t like frequent policy claims – Companies in Florida give most affordable rates to policyholders who only file infrequent claims. If you file a lot of claims you can look forward to either a policy non-renewal or much higher rates. Your insurance policy is intended for claims that you cannot pay yourself.

-

Insurance loss probability for a Scion iQ – Insurance companies take into consideration historical loss data for every vehicle when they set coverage costs for each model. Vehicles that statistically have increased claim numbers or amounts will cost more to insure.

The table below illustrates the actual insurance loss data for Scion iQ vehicles. For each policy coverage, the claim amount for all vehicles, as an average, is equal to 100. Numbers shown that are under 100 suggest a positive loss record, while percentages above 100 point to more frequent losses or statistically larger losses.

Car Insurance Loss Data for Scion iQ Models Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Scion iQ 77 81 75 BETTERAVERAGEWORSEEmpty fields indicate not enough data collected

Data Source: iihs.org (Insurance Institute for Highway Safety) for 2013-2015 Model Years

Save with these discounts

Auto insurance companies don’t necessarily list all discounts very well, so the below list has a few of the more well known and the harder-to-find discounts that may be available.

- Accident Free – Drivers who don’t have accidents can earn big discounts as compared to drivers with a long claim history.

- Active Service Discounts – Having a family member in the military may lower your rates slightly.

- Discounts for Responsible Drivers – Insureds without accidents can get discounts for up to 45% lower rates compared to accident prone drivers.

- Federal Employees – Simply working for the federal government can save as much as 8% with a few insurance companies.

- Theft Deterrent System – Vehicles that have factory anti-theft systems are less likely to be stolen and will save you 10% or more on iQ insurance in Jacksonville.

- More Vehicles More Savings – Insuring more than one vehicle on one policy can reduce rates for all insured vehicles.

- Early Renewal Discounts – Some insurance companies reward drivers for switching policies prior to your current iQ insurance policy expiring. This discount can save up to 10%.

- Student Driver Training – Have your child successfully complete driver’s ed class as it will make them better drivers and lower rates.

- One Accident Forgiven – Not necessarily a discount, but a few companies such as GEICO and Liberty Mutual will turn a blind eye to one accident before your rates go up as long as you don’t have any claims for a specific time period.

Don’t be surprised that most of the big mark downs will not be given to your bottom line cost. The majority will only reduce the cost of specific coverages such as liability and collision coverage. Even though the math looks like it’s possible to get free car insurance, that’s just not realistic.

A few popular companies and the discounts they provide are outlined below.

- Mercury Insurance includes discounts for good driver, multi-car, low natural disaster claims, professional/association, type of vehicle, accident-free, and good student.

- Farmers Insurance offers premium reductions for business and professional, electronic funds transfer, distant student, bundle discounts, alternative fuel, and early shopping.

- Farm Bureau offers discounts for safe driver, multi-policy, youthful driver, 55 and retired, and driver training.

- State Farm may offer discounts for good driver, multiple policy, anti-theft, good student, and student away at school.

- Allstate has discounts for early signing, defensive driver, anti-theft, resident student, and EZ pay plan discount.

- GEICO policyholders can earn discounts including seat belt use, anti-theft, multi-policy, driver training, military active duty, five-year accident-free, and good student.

Double check with all companies you are considering which credits you are entitled to. Some credits may not be available in Jacksonville. If you would like to see a list of insurance companies offering insurance discounts in Florida, click here to view.

Cheap car insurance rates are possible

We just presented quite a bit of information on how to lower your Scion iQ insurance auto insurance rates in Jacksonville. The key concept to understand is the more quotes you get, the more likely it is that you will get a better rate. You may even be surprised to find that the best price on car insurance is with a lesser-known regional company. These smaller insurers can often insure niche markets at a lower cost than their larger competitors like Allstate, GEICO and Progressive.

When you buy Jacksonville car insurance online, don’t be tempted to buy lower coverage limits just to save a few bucks. In too many instances, drivers have reduced collision coverage to discover at claim time that saving that couple of dollars actually costed them tens of thousands. Your aim should be to buy a smart amount of coverage at the lowest possible cost but still have enough coverage for asset protection.

Some insurance providers may not offer the ability to get a quote online and these regional insurance providers provide coverage only through independent agents. Low-cost Scion iQ insurance in Jacksonville is possible on the web in addition to many Jacksonville insurance agents, so you need to compare both to have the best rate selection.

How to find cheaper rates for Scion iQ insurance in Jacksonville

It takes a few minutes, but the best way to find low-cost prices for Scion iQ insurance in Jacksonville is to start comparing prices yearly from providers who sell insurance in Florida.

Step 1: Take a little time to learn about how your policy works and the things you can control to keep rates in check. Many factors that are responsible for high rates like at-fault accidents, careless driving, and a poor credit rating can be controlled by paying attention to minor details.

Step 2: Compare rates from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can only provide price estimates from one company like GEICO or State Farm, while independent agents can give you price quotes from multiple sources.

Step 3: Compare the quotes to your existing policy and see if you can save money. If you find a better price, verify that coverage does not lapse between policies.

One thing to remember is to compare the same deductibles and limits on every price quote and and to get price estimates from as many different insurance providers as possible. Doing this enables an accurate price comparison and the best price selection.

More information is located on the following sites:

- Keeping Children Safe in Crashes Video (iihs.org)

- Who Has Cheap Jacksonville Car Insurance for Business Use? (FAQ)

- How Much is Jacksonville Auto Insurance for a 20 Year Old Female? (FAQ)

- Who Has the Cheapest Jacksonville Auto Insurance for Teenage Males? (FAQ)

- Who Has Cheap Car Insurance for Postal Workers in Jacksonville? (FAQ)

- Safety Tips for Teen Drivers (Insurance Information Institute)

- Side Impact Crash Tests (iihs.org)